Paper wealth can be characterized as “easy come, easy go.”

The Chinese government’s stock market pump managed to produce many paper wealth billionaires.

By paper wealth, this entails of the net worth of individuals who owns the majority shares of a listed firm, whose fortunes have been dependent on the direction of share prices.

So a stock market pump inflates the owner’s worth and vice versa.

‘Easy come, easy go’ it has been for two of Hong Kong’s paper billionaires.

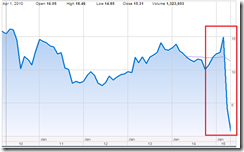

Piggybacking on the Chinese government’s stock market pump, Mr. Li Hejun, who at one time was considered China’s richest man based on the value of his majority stake in the Chinese solar company, Hanergy Thin Film Power Group Ltd. (Bloomberg HK: 566), according to Wall Street Journal, saw his holdings suffer when his firm’s share prices almost halved last Wednesday.

Trading was reportedly halted for the firm.

Interestingly, media seem to impute Mr. Li’s skipping his company’s annual meeting to the crash.

Yet prior to crash, according to the same Wall Street Journal, Hanergy’s shares “were up more than 42% since the beginning of the year and are more than triple their level of one year”.

Triple++ in about than a year!

Yet a day after the terrifying Hanergy episode, the fortunes a little-known electronics and property tycoon, Mr. Pan Sutong endured the same fate.

Stocks of Mr. Pan Sutong, the Goldin Financial Holdings Ltd. (Bloomberg HK:530) and Goldin Properties Holdings Ltd (Bloomberg HK: 283), which previously skyrocketed by about 350%, likewise collapsed!

According to the same report, "Goldin fell 43%, wiping $12 billion off its market value. A smaller company with the same owner, property developer Goldin Properties, fell by 41%, reducing its market capitalization by $4.6 billion"

Why shouldn’t a crash happen when prices have totally detached from valuations?

Here is a Bloomberg ex-post analysis: Goldin Financial’s revenue in the six months ending December was $34 million and more than 99 percent of its $181 million profit came from marking up the value of a 27-story office building in Hong Kong that’s still under construction. At its height on May 15, the company traded at a price-to-book ratio of nearly 25 times, compared with an average of about 1.5 times for stocks in the Hang Seng Index. (bold mine)

$22 billion worth of market cap for $34 billion of revenues at PBV of 25 times!

Back to the Wall Street Journal article, regulators have already warned of the excesses in Goldin Financials and likewise reported a connection between the two:

Filings with the Hong Kong exchange show Hanergy and Goldin Financial have previously worked together, although it was unclear whether the relationship contributed to Goldin’s fall. Hanergy said in a February disclosure it had appointed Goldin as an independent adviser for a supply agreement under which Hong Kong-listed Hanergy Thin Film would sell solar panels to its parent company.The Securities and Futures Commission, Hong Kong’s market regulator, warned investors to exercise “extreme caution” with Goldin Financial in March, noting that just 20 shareholders—including its chairman who owns a 70% stake—held nearly 99% of the company. The company said at the time that there was little it could do because the SFC didn’t disclose who those shareholders were. Both Goldin Financial and Goldin Properties issued filings Thursday to the Hong Kong market saying they are not “aware of any reasons” for the movement of the stocks. The companies didn’t respond to requests for comment.

More interestingly, Goldin’s shareholders have represented big time institutions like Norway’s sovereign wealth fund. From the Wall Street Journal report: (bold mine)

Goldin Properties is building a 117-story skyscraper in Tianjin, a city in northeastern China, that will be ringed by China’s largest polo complex. Illustrating Goldin Properties’ size, it will join the MSCI China Index, an index followed by global investors, at the end of this month. The property company had already garnered big investors. At the end of last year, Norway’s government pension fund was the biggest institutional shareholder, with a stake valued at $30 million. The $926 billion fund has been holding the stock since at least 2008, though it has trimmed the position in recent years, according to its annual reports. Norges Bank Investment Management, which manages the fund, declined to comment. Goldin Financial provides a form ofshort-term corporate financing known as factoring. It owns wineries in France and California and wine-storage facilities in China and invests in property.

As I have recently pointed out, governments (mostly via sovereign wealth funds) and central banks have at least $29 trillion of exposure on global stock markets. And stock market losses would extrapolate to eventual ‘deficits’ that would be shouldered by taxpayers. Fortunately yet, Norway's pension fund has been one of the early buyers.

And individual boom bust chapters have not just been in a Hong Kong event.

A Frankfurt listed German sanitary fitting firm Joyou AG (JY8: XETRA) which operates and has its headquarters in China recently saw its boom then nearly went to ZERO!

That’s because of this surprise announcement (Bloomberg): Joyou AG, which mainly operates in China, yesterday announced it will write down more than half of its capital and possibly file for insolvency. Losses of which according to Reuters has been due to “extraordinary writedown on shareholding in Hong Kong Zhongyu Sanitary Technology Ltd”

Nonetheless, the above reports represent the ex-post explanations.

But it is sad thing for the shareholders of these companies whose participation on the above issues would translate to staggering losses.

Crashing individual stocks have yet been a minority. Yet what happens when they become the majority?

Bottom line: Paper wealth are illusions. The obverse side of every mania is a crash.

No comments:

Post a Comment