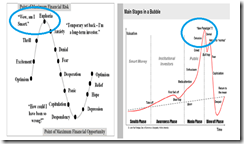

Gee. We really have reached the manic phase with more signs of fatal conceit from monetary authorities.

The mania in psychological context. This time is different. New Paradigm. New order. Boom emanates from my good policies. I am smart, infallible, and invincible. The salvation of social order is on my palms.

From Reuters

In other ages, we have called on shamans or saints in times of crisis when the usual remedies have not worked.In the stagnant world economy today, we have designated central bankers as our superheroes, and we are relying on their magical monetary powers to restart global growth.As the European Central Bank president, Mario Draghi, whom some have nicknamed Super Mario, said this month: "There was a time, not too long ago, when central banking was considered to be a rather boring and unexciting occupation."Not anymore. No one embodies this new glamour more than Mark Carney, the 48-year-old governor of the Bank of Canada, who has been tapped to lead the Bank of England, making him the first foreign governor in the institution's 319-year history.The bar for Carney could not be higher. A cartoon in the British papers made the point. It showed a Bethlehem inn with Joseph leading Mary on a donkey. The caption above the innkeeper's head declares: "Unless you're Mark Carney, you'll have to make do with the stable."

Wow. What deification for central bankers!

This is why we should expect central bankers to indulge in more inflationism or that for central bankers to push inflationism to the limits.

And media’s worship of central bankers means that the weight of policy making has shifted from the elected executive branch of government to the unelected monetary bureaucrats. In short, politicians have implicitly become subordinate to monetary authorities.

This also shows that central bankers are indirectly being pressured by well financed and political influential interest groups via such embellished reports.

Veneration of central bankers, the Bangko Sentral ng Pilipinas edition. From the BSP

The Bangko Sentral ng Pilipinas has been chosen as the 2013 Best Macroeconomic Regulator in the Asia Pacific Region by The Asian Banker, one of Asia’s leading financial services consultancies. The award was given during The Asian Banker Leadership Achievement Awards in Jakarta, Indonesia on 23 April 2013.

Ooh my. This resonates with the pre-crisis 9 awards the Bank of Cyprus received in 2011-2012. One of Cyprus major banks, the Bank of Cyprus then thought that they had reached some state of policy making nirvana, when they first eluded the Euro crisis, which was exposed in March 2013 as the emperor with no clothes, as discussed last Sunday.

Adam Smith warns of the consequences from the conceit by “the man of the system” in his classic Theory of Moral Sentiments (bold mine)

The man of system, on the contrary, is apt to be very wise in his own conceit; and is often so enamoured with the supposed beauty of his own ideal plan of government, that he cannot suffer the smallest deviation from any part of it. He goes on to establish it completely and in all its parts, without any regard either to the great interests, or to the strong prejudices which may oppose it. He seems to imagine that he can arrange the different members of a great society with as much ease as the hand arranges the different pieces upon a chess-board. He does not consider that the pieces upon the chess-board have no other principle of motion besides that which the hand impresses upon them; but that, in the great chess-board of human society, every single piece has a principle of motion of its own, altogether different from that which the legislature might chuse to impress upon it. If those two principles coincide and act in the same direction, the game of human society will go on easily and harmoniously, and is very likely to be happy and successful. If they are opposite or different, the game will go on miserably, and the society must be at all times in the highest degree of disorder.

All these are really signs to worry about.

Central banking hubris will inevitably lead to the "highest degree of disorder". Yet this is not a question of “if”, but a when.

And I would say pretty much soon.

No comments:

Post a Comment