Those bullish with the casino industry should learn of the risks involved.

One example from the Yahoo News Singapore

High-rollers get lavish treatment and hefty credit lines at Singapore's two casinos, like any other gaming house in the world. But here, more of them skip town without paying their debt, a matter of increasing concern for investors.Three years after Singapore allowed casinos to open, Genting Singapore PLC's Resorts World Sentosa and Las Vegas Sands Corp's Marina Bay Sands have become the world's most profitable. Chinese nationals account for around half of the VIP gaming volume at their tables.An examination of court documents by Reuters and a series of interviews with lawyers and industry executives reveal that several of the gamblers have run up millions of dollars in debt and then scampered back to China, where they are effectively untouchable.Resorts World sued Chinese gambler Kuok Sio Kun in Singapore last year to recover S$2.2 million (1.1 million pounds). But more than six months on, the casino has not even managed to serve court papers to the Macau-based woman.After several letters of demand went unanswered for months, it tapped a Singapore law firm to sue the 46-year-old, court documents show.

The lesson from the above is that casinos are highly sensitive to economic performances.

To show more examples, US casinos suffered losses during the last recession. Some continue to bleed. Indian tribes in the US recently asked for bailout after a casino they owned suffered losses. The defunct Las Vegas Sahara has been bought by foreigners and will operate under a new name. Here is a watch ‘death’ list of Las Vegas casinos

A study showed that diminishing disposable income in the Eurozone has led to the losses of Belgian casinos.

In addition, casinos are subject to competition, both from the real estate peers and from online providers.

The Philippines has opened one major casino project (Solaire) this year, whose expansion will be financed by Php 14 billion from 3 banks. Such loans will add up to the systemic debt being rapidly incurred via yield chasing dynamics in the property sector.

There are reportedly three more major projects slated to open in the coming years: SM’s Belle Corp and Macau’s Melco Crown Entertainment’s Belle Grande, the joint project between Japanese billionaire Kazuo Okada and the Gokongwei group on the Manila Bay Resorts ($2 billion) and also the tie up between Andrew Tan’s Alliance Global Group and Malaysia’s Genting Corp on Resorts World Bayshore ($1.1 billion).

I would venture a guess that bank loans will also be the major source of finance for the industry, again swiftly adding to the country’s debt levels.

All these have been sold to the public as entailing growth in the tourism industry, which is an illusion.

The mainstream ignores the fact that these casinos will be competing with the regional counterparts for essentially the same (regional) market.

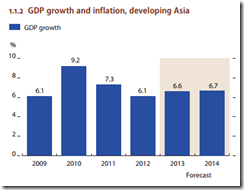

On the supply side, the growing numbers of casinos in the region may eventually reach saturation point (even assuming no recession). The Philippine gaming industry has reportedly been growing at a CAGR of 28% (!!!), which is about THRICE 3x growth rate of developing Asia, the fastest in the region. (chart from ADB)

On the demand side, the fragile state of the global economy may mean that demand may evaporate when a crisis emerges. Remember Asia has a credit bubble.

And the loses suffered by Singapore casino operators from unscrupulous bettors are just signs from the periphery, particularly the vulnerable Chinese economy, of the possible things to come.

As a side note Fitch ratings just downgraded China’s local government debt. Local governments have racked up an estimated US$2.1 trillion which is equivalent of 25% of GDP. This makes the Chinese bettor market equally fragile.

And worst, such cumulative bullishness comes in the backdrop of artificially lowered rates, which industry operators and the unwitting public presume will be everlasting.

And even with the employ of hundreds of so-called experts, hardly anyone sees the risks from the above. Rose colored glasses seems to be the general consensus, especially promoted by media, in the presumption that this time is different.

At the end of the day, basic economic logic says that all these yield chasing activities (whether the shopping mall, casino, housing and vertical projects) will end badly.

But these politically connected behemoths are most likely to be bailed out, when fortunes reverse.

Forewarned is Forearmed.

1 comment:

Vice Stocks, VICEX, ave performed quite well, but not as well as The Philippines, EPHE, as is seen in the linked Yahoo Finance chart

Post a Comment