Casey Research economist Bud Conrad suggests that the recent flash crash in gold may have been engineered.

Can markets really be influenced by big players? Well, was the LIBOR rate accurately reported by huge banks? Have players ever tried to corner markets? The answer to all the above, unfortunately, is yes.There's an even bigger problem with the legal structure of the futures market: even the segregated funds on deposit can be pilfered by the broker for the brokerage's other obligations. That is what happened to MF Global customers under Mr. Corzine. (I had an account with a predecessor company called Man Financial – the "MF" in the name. I also had an account with Refco, which is now defunct. Fortunately, the daggers did not hit my account, since I was not a holder when the catastrophes occurred.) My take: the futures market is dangerous, and not a place for beginners.One last note: after the Bankruptcy Act of 2005, the regulations support the brokers, not the investors, when there are questions of legality about losses in individual investment accounts.

The recent actions in the gold markets reveals of the stark difference between paper gold and physical gold markets.

Paper gold markets have essentially been influenced by Wall Street, who in turn are influenced by policymakers such as the FED and central bank cartel, as well as, the governments via regulations and mandates.

In contrast, the physical gold represents real demand and supply which involves the consuming and investing public and real inventories around the world.

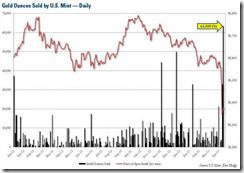

So when gold prices suffered a quasi price crash, instead of triggering a wave of selling spree, retail participants rose to the occasion and used such opportunity to accumulate with such ferocity.

Of course it would be a mistake to view retail buying as non-investments or as non-investors as media commonly portrays.

Said differently panic selling in Wall Street extrapolated to the inverse scenario—panic buying in the global physical market as shown by the chart from US Global Investors.

In short, the gold flash crash demonstrated the contrasting actions between politically backed financial institutions and of non political influenced individuals.

There has been more accounts of rapid depletion of gold inventories as a result of the flash crash. Premium on physical gold continues to rise, particularly in Asia as of this writing, as a result to supply constraints

Even prior to the flash crash, physical markets kept showing signs of vigorous demand, so the crash shouldn’t have happened, but it did.

This tell us that the parallel universe or patent disparity between gold’s paper markets and the physical markets implies of the anomalous nature with the current pricing dynamics of gold.

Thus logic supports the idea that there has been an ongoing suppression-manipulation scheme against gold prices or an undeclared war on gold.

And it would also signify a mistake to assert otherwise.

We don’t really need conspiracy theories, for the simple reason that manipulation of the marketplace has been legitimated and a principal tool used for implementing social policies.

Proof? From Ben Bernanke’s 2010 speech: (bold mine)

Notably, since December 2008, the FOMC has held its target for the federal funds rate in a range of 0 to 25 basis points. Moreover, since March 2009, the Committee has consistently stated its expectation that economic conditions are likely to warrant exceptionally low policy rates for an extended period. Partially in response to FOMC communications, futures markets quotes suggest that investors are not anticipating significant policy tightening by the Federal Reserve for quite some time. Market expectations for continued accommodative policy have in turn helped reduce interest rates on a range of short- and medium-term financial instruments to quite low levels, indeed not far above the zero lower bound on nominal interest rates in many cases.The FOMC has also acted to improve market functioning and to push longer-term interest rates lower through its large-scale purchases of agency debt, agency mortgage-backed securities (MBS), and longer-term Treasury securities, of which the Federal Reserve currently holds more than $2 trillion.

Or from a recent speech

The expected path of short-term real interest rates is, of course, influenced by monetary policy, both the current stance of policy and market participants' expectations of how policy will evolve. The stance of monetary policy at any given time, in turn, is driven largely by the economic outlook, the risks surrounding that outlook, and at times other factors, such as whether the zero lower bound on nominal interest rates is binding

The above speeches showcases how the FED works to influence the interest rate markets and thereby financial and economic forces. They are direct manipulations on the bond markets and indirect manipulations on other financial instruments.

Market manipulation has also been acknowledged by authorities. The New York Fed bragged about how FED policies has boosted US stock markets. Japan’s finance minister recently said that they have a target for their stock markets.

Governments have also been engaged in banning short sales in both the stock markets and the bond markets to influence prices. Have this not been manipulation?

Here is a recent one.

From the Financial Times

It’s called the law of unintended consequences. Last November, European regulators were fed up with hedge funds using the derivatives market to bet against sovereigns so they imposed a ban on outright speculation.But fund managers, not being ones to roll over and play nice for regulators, have found other ways to express the same view – this time in a way that analysts warn could increase borrowing costs for the banking sector.Six months on from the ban on buying naked sovereign CDS protection – where the investor does not own the underlying government bond – it is clear that negative bets against large financials have emerged as a partial replacement.A CDS, or credit default swap, protects the buyer against the risk of a company or government going into default. The instrument is worth more if the risks of default is perceived to be higher.Investors are buying protection on European banks on the basis that banks and sovereigns are so intimately linked that any increased risk of a sovereign default will increase the value of a bank CDS in a similar way to a sovereign CDS.

Using organized force or governments to prevent markets from clearing or from revealing their real conditions are manipulations. Government's actions, thereby, signify as the ultimate perpetrators of insider trading and of picking winners and losers.

So if the stocks and bond markets have been subjected to interventions, or may I say manipulations, directly or indirectly, then why should the gold-commodity markets be any different?

As I recently wrote,

A famous politician once said, You can fool all the people some of the time, and some of the people all the time, but you cannot fool all the people all the time.The pushback from the gold bear raid as seen in the physical gold market implies that the governments and their apologists cannot fool all the people all the time.

No comments:

Post a Comment