Indonesia’s economic boom has been driven by the resource industry. So declares this Bloomberg article:

The world’s fourth most-populous nation is seeing its economy reshaped as cities on islands including Sumatera and Borneo grow faster than Java, home to the nation’s capital, Jakarta. A transmigration program championed by former President Suharto in the 1980s, combined with China’s demand for palm oil, coal and iron from Indonesia’s rural provinces, helped outlying cities expand as much as 4 percentage points faster than the national average over the past decade.As China’s expansion boosts incomes of miners and farmers in some of the sleepiest and most far-flung corners of Asia, companies from Unilever Plc (ULVR) to Toyota Motor Corp (7203). are flocking to Indonesia’s second-tier cities to tap their rising demand. At the same time, increasing urbanization raises pressure on President Susilo Bambang Yudhoyono to improve infrastructure and strains environmental resources…The boom in second-tier cities has helped swell the middle class. Seven million Indonesians joined their ranks each year for the past seven years, according to a 2011 World Bank report. Private spending grew 5.4 percent in the fourth quarter of 2012 from a year earlier, and consumer confidence in March was 116.8, the eighth straight month the indicator exceeded 115. Pekanbaru, Pontianak, Karawang, Makassar and Balikpapan regions will lead growth, McKinsey says…

Government joins the spending boom…

As new shops and apartments spring up, the government is trying to keep up, spending more on roads and ports. President Yudhoyono plans to build 30 new industrial zones across the 17,000-island archipelago and to spend $125 billion on infrastructure by 2025, including $12 billion on 20,000 kilometers of roads, enough to go halfway round the world….

The conclusion…

The main driver behind the increasing wealth and power of the nation’s regional capitals is a decade-long boom in the nation’s resources. In the past 12 years, palm oil prices have more than tripled, even after a 34 percent drop in the past year. China-led demand has lifted coal, copper and gold as much as fourfold in a decade.

A very important lesson I’ve learned from the great proto Austrian Frederic Bastiat is to differentiate between the seen or the “immediate; it manifests itself simultaneously with its cause - it is seen” and the unseen or the “series of effects”.

While it may be true that resources boom have on the surface contributed to the boom, what hasn’t been seen are the more important underlying factors that has led to a property boom in “second tiered cities”.

Like the Philippines the so-called boom in secondary cities are being driven by credit expansion (red arrow left pane, chart from the IMF).

Importantly credit growth has been accelerating since 2011 (light blue ellipse) amidst the backdrop of zero bound or record low interest rates.

Indonesia’s loans to the private sector has ballooned by 50% since 2011 (tradingeconomics.com)

Such credit boom has not only been reflected on the property sector but also to Indonesia’s stock market

chart from tradingeconomics.com

Like the Phisix, the zooming JCI continues to establish fresh record highs.

Remember both property and stock markets are titles to capital goods which are main beneficiaries of typical credit bubbles

Indonesia’s money supply M2 has also swelled by 33% since 2011. (tradingeconomics). So booming credit has likewise been manifested on money supply.

Indonesia’s credit bubble has been putting pressure on producers prices. Also Indonesia’s government plans to raise minimum wages by 50% this year!

Although Indonesia has received accolades for previously imposing austerity as fiscal balance has markedly improved, the reality is that part of the improving government debt-to-gdp (23.1% in 2012) has been due to the cosmetics, or improvements on the denominator, provided by statistical growth fueled by Indonesia’s credit boom.

Indonesia’s fiscal balance remains modestly negative

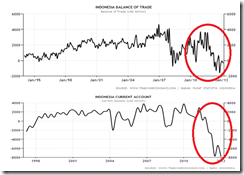

Nonetheless, credit fueled private consumption combined with government spending has now been manifesting on Indonesia’s trade and current account balance which has sharply deteriorated.

This means the Indonesian economy would have rely on foreigners to finance the boom which makes her vulnerable to "sudden stops".

So yes, while media paints Indonesia boom or may I say “illusion of success” on the resource trade, the reality is that such boom has been an embodiment of the business cycle in motion.

Yet that which is unsustainable won’t last.

People hardly learn from history.

No comments:

Post a Comment