Mainstream media attempts to downplay the “conspiracy” theory that the current plunge in gold prices may have been engineered.

So they allude to losses incurred by central banks in the wake of the selloffs

From a Bloomberg article

Central banks are among the biggest losers because they own 31,694.8 metric tons, or 19 percent of all the gold mined, according to the World Gold Council in London. After rallying for 12 straight years, the metal has tumbled 28 percent from its September 2011 record of $1,923.70 an ounce.

Central bank-got-hit meme looks like a press release.

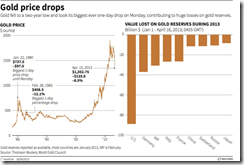

Reuters has a chart suggesting the same

I don’t know about other central banks, but for the US government via the US FEDERAL RESERVE and the US Treasury, the recent slump has hardly impacted the dollar value of gold reserves because they are “valued” at 42.2222 per troy ounce.

This straight from the US Federal Reserve’s footnote on US Reserve Assets as of September 2012

Gold held "under earmark" at Federal Reserve Banks for foreign and international accounts is not included in the gold stock of the United States; see table 3.13, line 3. Gold stock is valued at $42.22 per fine troy ounce.

And this from the US Treasury

The Status Report of U.S. Treasury-Owned Gold (Gold Report):

In effect, based on the US government's accounting treatment of gold reserves, media’s reporting can be seen as deceptive or misleading.

And that's even to assume yet that the official holdings of gold are intact, which is questionable. It would reportedly take SEVEN years for the FED to return the gold reserves of the Bundesbank. Why?

I am inclined to think that this quasi-crash may have provided the window for the Fed to load up gold to return to the Bundesbank. Talk about conspiracy.

No comments:

Post a Comment