Mr. Stephen Roach, Chairman of Morgan Stanley Asia, writing at the Project Syndicate thinks so,

Reports of ghost cities, bridges to nowhere, and empty new airports are fueling concern among Western analysts that an unbalanced Chinese economy cannot rebound as it did in the second half of 2009. With fixed investment nearing the unprecedented threshold of 50% of GDP, they fear that another investment-led fiscal stimulus will only hasten the inevitable China-collapse scenario.

But the pessimists’ hype overlooks one of the most important drivers of China’s modernization: the greatest urbanization story the world has ever seen. In 2011, the urban share of the Chinese population surpassed 50% for the first time, reaching 51.3%, compared to less than 20% in 1980. Moreover, according to OECD projections, China’s already burgeoning urban population should expand by more than 300 million by 2030 – an increment almost equal to the current population of the United States. With rural-to-urban migration averaging 15 to 20 million people per year, today’s so-called ghost cities quickly become tomorrow’s thriving metropolitan areas.

Shanghai Pudong is the classic example of how an “empty” urban construction project in the late 1990’s quickly became a fully occupied urban center, with a population today of roughly 5.5 million. A McKinsey study estimates that by 2025 China will have more than 220 cities with populations in excess of one million, versus 125 in 2010, and that 23 mega-cities will have a population of at least five million.

China cannot afford to wait to build its new cities. Instead, investment and construction must be aligned with the future influx of urban dwellers. The “ghost city” critique misses this point entirely.

All of this is part of China’s grand plan. The producer model, which worked brilliantly for 30 years, cannot take China to the promised land of prosperity. The Chinese leadership has long known this, as Premier Wen Jiabao signaled with his famous 2007 “Four ‘Uns’” critique – warning of an “unstable, unbalanced, uncoordinated, and ultimately unsustainable” economy.

I have deep respect for Mr. Stephen Roach but I think his “urbanization” argument hardly distinguishes from the other public work projects such as infrastructure and transportation. They are all anchored on justifications of centrally planned interventions that presupposes omniscience or the superiority of knowledge of political authorities, as well as, the incontrovertibility of such trends (which for me accounts as the folly of reading past trends into the future; or “fighting the last war”).

In short, urbanization, based on government design, seems like a lipstick on a pig.

Urbanization according to Wikipedia is closely linked to modernization, industrialization, and the sociological process of rationalization.

Urbanization is characterized by, again Wikipedia.org

Cities are known to be places where money, services and wealth are centralized. Many rural inhabitants come to the city for reasons of seeking fortunes and social mobility. Businesses, which provide jobs and exchange capital are more concentrated in urban areas. Whether the source is trade or tourism, it is also through the ports or banking systems that foreign money flows into a country, commonly located in cities.

Urbanization in reality are symptoms of the 20th century model of intertwined centralized social activities based on mass production, mass media and markets which drew development and population to urban areas that paved way for the age of urbanization.

But are we still in the industrial age or are we shifting to the information age?

While Urbanization has still been an ongoing phenomenon, signs are that current centralized trends have been shifting.

For instance in China, demographic trends show that population and development has been moving inland. This may be partly due to government projects, China’s spontaneous economic response to the unfolding events around the world and the alleged reshaping or “rebalancing” of China’s economy (The Economist)

But what mainstream seem to ignore is that mass production has been transitioning towards specialization, which is why Asia became a supply chain network.

Moreover, future trends points to home based production for simple products (3-D printing anyone?)

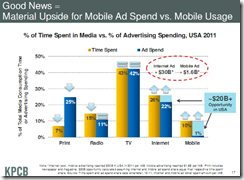

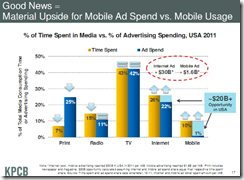

Chart from KPCB’s Mary Meeker

Decentralized social media via the internet has also been challenging mass media. In terms of advertising, mobile and internet have been dramatically gaining at the expense of Radio and Print. Even revenue growth from ads on TV has been stagnating.

Also, mass markets are being turned into niche or specialty markets.

Specialization of production and niche markets has led to grassroots development.

Proof?

The expansion of the booming Business Process Outsourcing has not only been within cities but to secondary cities and to rural areas as well. This applies both to India and the Philippines.

As I previously wrote,

Also business focus will increasingly be directed to specific needs (niche marketing) rather than mass production and also on where the consumers and markets are.

In the Philippines, shopping malls have sprouted not only in major cities but also in capitals of provinces or secondary cities. Take for example the largest shopping mall chain the SM Group which has 43 malls nationwide and growing. This is a noteworthy example of the deepening dispersion trends, where facilities have been mushrooming outside of mega cities.

I might add that SM has reportedly been targeting rural or provincial areas for expansion due to a booming agricultural economy and has been on a land-buying binge in Bacolod, Tacloban, Baguio, Bulacan, and Laguna, Quezon and Pangasingan.

Of course the agriculture economy has been part of the boom, but as noted above, even BPOs are headed towards rural areas. There may also be other telecommuters or home based technology businesses, aside from the large informal economy and remittance based income.

What the point?

Decentralization is bound to upend centralized based social activities of the 20th century

As the prescient Alvin Toffler wrote in Third Wave (p. 298-299)

The Third wave alters our spatial experience by dispersing rather than concentrating population. While millions of people continue to pour into urban areas in the still industrializing parts of the world, all the high technology countries are already experiencing a reversal of this flow. Tokyo, London, Zurich, Glasgow, and dozens of other major cities are all losing population while middle-sized or smaller cities are showing gains…

This redistribution of and de-concentration of population will, in due time, alter our assumption and expectations about personal as well as social space about commuting distances, about housing density and many other things.

This has gradually been happening today.

Bottom line: Urbanization will unlikely save China’s Keynesian centrally planned capital spending boom from turning into a bust.